|

In 2017, real estate construction contributed nearly 6% to India’s GDP and the figure is likely to climb to almost 13% by 2025. With more than 40% of the population expected to live in urban India by 2030, the residential sector is expected to demand almost 25 million additional mid-end and affordable units (IRP, 2020). The sector is the second largest employer in the country, which employs over 51 million people (Saigal, 2020). The scale and growth trends of the sector indicate the need for strategies and policies to be framed to ensure that this growth occurs sustainably and avoids the lock-in of carbon-intensive building materials and technologies in the process. In India, like many other developing countries, the building and construction sector operates in two dichotomies. The first is large-scale, high-value infrastructure development, wherein steel and glass high-rise towers and fancy apartment buildings are designed and built by large developers and institutions with support from an army of architects, engineers, and consultants. And, the other is mostly individual-owned housing units and small constructions driven by local contractors and masons and built without much technical assistance (Wells, 2007). Although the latter are mostly small in size, they represent a large proportion of construction-related activity, especially in small cities and towns. Construction practices in these two cases vary significantly – not only concerning the choice of materials, typologies, and designs but also with very distinct needs and solutions in terms of operational parameters and the use of appliances and mechanical, engineering, and plumbing systems. In this, academia and technical agencies have an important role in developing trustworthy knowledge and databases that can assist in driving data-based decision-making.

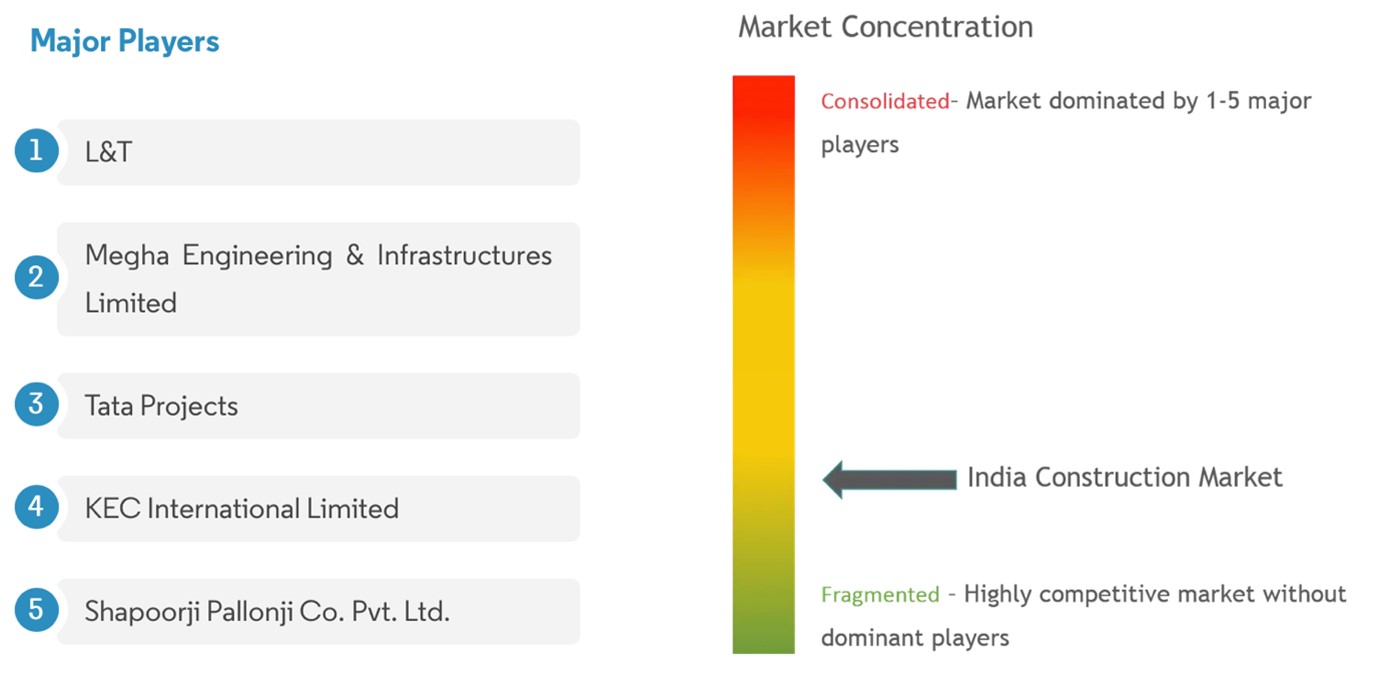

Market fragmentation

with a concentration of large players at one end and heavily informal

players at the other From a governance perspective, a large dependence on informal labour in the construction sector creates further challenges. Similar concerns apply to the processes involving the extraction of mineral resources, including river sand, stone for aggregates, soil and coal for brick production, and so on, for construction activities. These activities are found to be functioning ‘under the radar’, often with local political support. Furthermore, a significant portion of the sector operates outside the purview of the established norms and regulations with respect to the terms and conditions of employment or supply chains for certain types of building materials. This has led to the concerns around the informality in the sector becoming significantly more challenging but all the more essential to be addressed (Amutha, 2018). The fragmentation of the sector’s value chain is evident in the combined list of stakeholders and actors across different geographical and typological categories. It is estimated that the construction industry in India is directly or indirectly working across 250 sub-sectors with their intricate linkages (Waghmare and Bhalerao, 2016). This intertwined ecosystem of actors necessitates the adoption of novel approaches for targeted policy design interventions to bring transformative change to the sector. The policy initiatives not only need to integrate the perspectives of the various stakeholders and address their core needs but also actively seek to enhance cooperation and collaboration among them. It is important to strengthen information flows and knowledge sharing between actors through improved communication in forms that users with varying capacities can understand and adopt them. Sharing best practices and information around innovative materials and technologies is essential to build capacities in the sector. Free flow of such information through credible sources can lead to higher levels of trust regarding the ‘sustainability’ of products and bring standardisation in taxonomies and common industry parlance. Here, robust certification systems can play an important and convergent role in aligning policymaking, including regulations, incentives, codes, and standards, with market forces and financial flows as well as knowledge systems. Certification systems, however, must adhere to the highest quality standards in terms of addressing various socio-environmental impacts of building design and construction using a cradle-to-cradle approach. It is clear that in a sector as vast, complex, and fragmented as the buildings and construction sector, a deep understanding of the drivers and barriers towards sustainability from a multi-stakeholder perspective is critical. This can enable the adoption of strategic carrot-and-stick mechanisms tailored to various ecosystem actors and positively influence responsible choice-making towards the same. References

Amutha, D. 2018. A study of trend and growth of employment in informal

sector and construction industry. Details available at

https://ssrn.com/abstract=3256181, last accessed on 9 October,

2022

Mohak Gupta |