|

Micro-enterprises

(MEs)

play a vital role in India’s economic empowerment as more than 10.76 crore

jobs are created by 636 lakh MEs.1 They are engines that boost job creation

and fuel sustainable economic development. Despite their crucial role,

growth in the micro sector is limited owing to the constraint of limited

access to information and finance. According to the sixth Micro, Small and

Medium Enterprises (MSME) census, barely 2.3 per cent of MSME units in India

have access to finance from financial institutions, including non-banking

finance companies (NBFCs) and microfinance institutions (MFIs). In

comparison, 78.2 per cent of MSME entrepreneurs had to fund their

enterprises, which displays the risk a micro-entrepreneur carries in the

absence of proper financial accessibility. The ability of the financing

system to cater to the growing needs of the micro-enterprises credit remains

limited. Based on multiple pieces of literature from ground and Development

Alternatives’ experience with rural MEs, some of the reasons that hamper

access to bank-based financing for MEs are:

Access to reliable information and support services: The financial landscape

in India is changing rapidly with the acceleration of digital finance. Yet,

access to reliable information remains limited, affecting the accessibility

of credit for MEs. The lack of a single-window facility for MEs is often a

deterrent, as their requirement for credit is timely access, which leads

them away from the formal source of credit.

Low flexibility of formal sources of credit: India’s MEs have diverse needs

and are distributed into multiple sectors. Catering to such diversity

requires a high degree of flexibility and customisation from credit

institutions. But most schemes/products are one-size-fits-all types, and the

loan products have low amortisation, resulting in limited options for

micro-entrepreneurs to access formal credit facilities.

Prejudice of financial institutions against MEs: Small MEs, especially those

based in the rural side, are often out of the ambit of credit assessment,

such as the credit score provided by Credit Information Bureau (India)

Limited (CIBIL) or any other relevant parameter owing to their informal

operation processes as well as limited record-keeping capacity. Rural

bankers are especially apprehensive of non-performing assets. But the

available data comparing micro-enterprise and large enterprise access to

credit suggest otherwise. According to the Economic Survey 2017-18, out of

the total outstanding credit disbursed by banks of INR 26,041 billion as of

November 2017 82.6 per cent was lent to large enterprises and 17.4 per cent

to MSMEs. Whereas, the non-performing assets of large enterprises are

approximately 1.5 times more than those of micro-enterprises.2

Considering the above shortcomings of the

banking system, microfinance institutions (MFIs) have attempted to fill in

the gap by providing easy access to loans. MFIs have contributed a

significant portion of formal loan portfolios, which stand at INR 1,01,663

crore, accounting for 35 per cent of the total industry portfolio of

financial institutions (Bharat Micro-Finance Report, 2020). But, the high

rate of interest and the joint liability group-based loan disbursal process

of MFIs often make it difficult for individual MEs to access finance. The

recent Master Direction – Reserve Bank of India (Regulatory Framework for

Microfinance Loans) Directions, 2022 has further empowered the MFIs by

removing the cap on interest rates.3 This will not only increase

the burden on micro-entrepreneurs but also remove the bargaining power of

the loanees. Additionally, determining the loan amount on the basis of

family income may leave many new aspiring entrepreneurs out of the ambit of

credit, especially the youth.

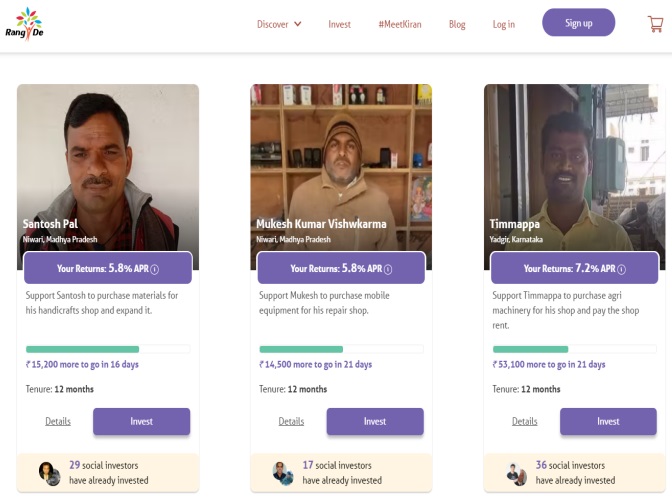

Development Alternatives in partnership with

Rang De has enabled access to loans worth INR 2 crore to 583 entrepreneurs

through Rang De's peer-to-peer social investing platform.

Financial accessibility, especially for MEs, requires systemic and

innovative solutions that not only focus on access to credit but also ensure

steady repayment ability of the loanees. In such aspects, the growing

numbers of blended financial products can play a vital role. Blended

financial products, including social investment, government-funded

developmental schemes, and debt from banks and NBFCs, can help further

penetrate financial inclusion as well as mitigate associated risks.

For a section of the Indian population that are out of the credit ambit or

‘digitally absent’, solutions such as account aggregation are being

innovated by OCEN (Open Credit Enablement Network). It uses embedded finance

technology, and can also enhance the tools for credit assessment.

References 1MSME.

2022. Annual Report Ministry of MSME India, 2021- 22. Last accessed on

20 May 2022 at

https://msme.gov.in/annual-report-2021-22 2TransUnion

CIBIL Limited. 2020. MSME Pulse. Last accessed on 20 May, 2022 at

https://www.transunioncibil.com/resources/tucibil/doc/insights/reports/report-msme-pulse-october-2020.pdf 3Reserve

Bank of India. n.d. Last accessed on 20 May, 2022 at

https://rbi.org.in/Scripts/NotificationUser.aspx?Id=12256&Mode=0#:~:text=

Ankit Mudgal

Debasis Ray |