|

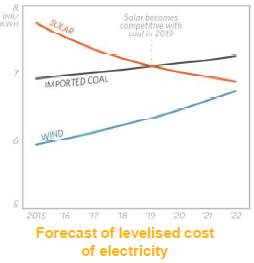

Green Bonding Our Way to Sustainable Energy R egarded as the third most attractive market for renewable energy, India has set itself an ambitious target of achieving 175 GW of renewable energy capacity by 2022, from a current figure of 30 GW. Besides the obvious environmental benefits, there is a growing realisation of multiple economic and social benefits of clean energy. Many of the renewable sources especially solar and wind energy are now within reach of achieving grid parity as they are becoming cost-competitive.Such a transition, however, demands a huge funding of US $200 billion. High rates of interest and poor terms for debt, raises the cost of clean energy in India by 24 to 32 per cent as compared to US and Europe. 1 This together with insufficient budgetary allocation and a large fiscal deficit makes financing a daunting task.Green Bonds Like any other bond, it is a financial instrument

used for raising funds from the debt market for projects relating to

renewable energy, climate-mitigation/adaptation etc. The lower rates of

interest on such bonds makes it attractive for the issuer as a

commitment is seen towards clean and green development. For the

investor, the incentive lies in a stable return as the risk of

non-performance lies with the issuer and not on the success of the

project. Globally the green bonds market has increased 3-folds in size and is forecasted to jump to the US $100 billion mark by the end of 2015. 2 Historically, led by multilateral banks such as World Bank, Asian Development Bank, European Investment Bank and national governments; many corporate players are now entering the field. In India, the Export-Import Bank kick-started green bonds, issuing bonds worth US $500 million, followed by Yes Bank, which has raised US $160 million.3 The oversubscription in these issues highlights the keenness amongst investors to take on projects with positive environmental impact.Can ‘Green Bonds’ be the Magical Solution? The answer, unfortunately, is a bit murky. While ‘green’ bonds seem to offer us a good alternative, the market is still at its infancy. The definition and standards of a ‘green bond’ are rather vague, as it has mostly been left at the discretion of the issuer. For instance, should bonds issued by a nuclear power plant be considered green, as on one hand there is lowering of emissions but on the other hand, there is creation of toxic waste? 4The danger of ‘greenwashing’ (i.e. using funds for purposes other than what they were originally issued for) along with the ambiguity on transparency and reporting aspects increases the risk of dampening investors’ confidence and the market’s integrity. The problem becomes murkier, with the issue of ‘additionality’ - are green bonds enabling funding of new projects (new capital) or simply refinancing old ones producing no ‘new’ environmental benefits. For example, the repackaging of its existing loans and selling them as ‘social impact bonds’ by Lloyds Bank5 or refinancing of bonds that were initially issued for building energy efficient building by MIT.6 India, further, faces the challenges of high currency hedging costs, poor sovereign ratings, double taxation and low tenure (averaging 3-10 years as compared to 10-15 years in other countries).7Efforts are being made in the forms of Green Bond Principles (voluntary guidelines for issuance of green bonds), standards and list of third party verifiers by Climate Bond Initiative, Principles for Responsible Investment and Centre for International Climate and Environmental Research (CICERO) etc. These are, however, voluntary guidelines and still in the development stage. For a healthy development of the green bond market, there must a clearer and more consistent understanding of definitions and standards including impact assessments, reporting etc. As the Economist rightly notes "it needs to strike a balance between accepting anything (diluting the attraction of green bonds as instruments to diversify climate risk) and being so strict that hardly anyone can meet the criteria."8 In India, PACE-D have further recommended: • Enhancing the risk liquidity facility to counter higher costs due to currency fluctuations • Seeking support from the Green Climate Fund for risk mitigation products • Reducing hedging costs via indexing electricity tariffs to inflation etc.9 Given the trends, it seems that green bonds are here to stay. Which way they will finally head, it is too early to comment. q Mandira Thakur Endnotes 1 Climate Policy Initiative, 2012, "Meeting India’s Renewable Energy Targets: The Financing Challenge" 2 Climate Bonds Initiative, 2014, "Bonds and Climate Change: The State of the Market 2014" 3 Bhaskar, U., 2015, "India plans push for green bonds", Mint 4 ibid 5 Grene, S., 2015, "The dark side of green bonds", Financial Times 6 Gunther, M., 2014, "Can Green Bonds Bankroll A Clean Energy Revolution?", Environment 360 7 PACE-D (Partnership to Advance Clean Energy-Development) Technical Assistance Programme, 2014, "Issue Paper: Green Bonds in India" 8 Economist, 2014, "Green grow the markets, O" [online] 9 PACE-D (Partnership to Advance Clean Energy-Development) Technical Assistance Programme, 2014, "Issue Paper: Green Bonds in India" |