|

'Money Movement' - A Story of Innovation, Inclusion,

and Collaboration

Access to finance plays a major role in the evolution of entrepreneurship and economic growth of any country as it acts as a catalyst for the development of mini- and micro-enterprises, which constitute 99.5% of all micro, small, and medium enterprises (GoI 2022). For many years now, there has been a strong drive for the financial inclusion of micro-enterprises. Although several programmes have been launched, complete financial inclusion is a long way off, as micro-enterprises still suffer from a lack of easy and affordable access to finance. Data suggest that such enterprises receive less than 5% of total loans by banks and non-banking financial companies (NBFCs) going to MSMEs (Bandyopadhyay 2021). As compared to enterprises with a turnover of less than $12,500, larger-sized and medium-sized firms were found to have higher probabilities of formal funding as the most important source.

The financial requirement of setting up a micro-enterprise usually ranges from $350 to around $3500. This range is such that, on one hand, banks often find it difficult to provide a credit of such small amounts and, on the other hand, availing of loans from microfinance institutions (MFIs) involves legal formalities and high interest rates. Thus, this segment of micro-enterprises gets excluded from the financial services from both banks as well as MFIs. The financial gap in this segment has been described as a problem of the ‘missing middle’. In most places, this forces micro-enterprises to opt for informal lending sources with high-interest rates, thereby forcing them into a vicious cycle of debt.

To overcome this challenge, Development Alternatives (DA), through various projects, has innovated solutions that are community-led and provide easy access to collateral-free, formal credit at affordable rates. DA’s three-pronged approach for meeting the financial needs of communities includes options such as:

To overcome this challenge, Development Alternatives (DA), through various projects, has innovated solutions that are community-led and provide easy access to collateral-free, formal credit at affordable rates. DA’s three-pronged approach for meeting the financial needs of communities includes options such as:

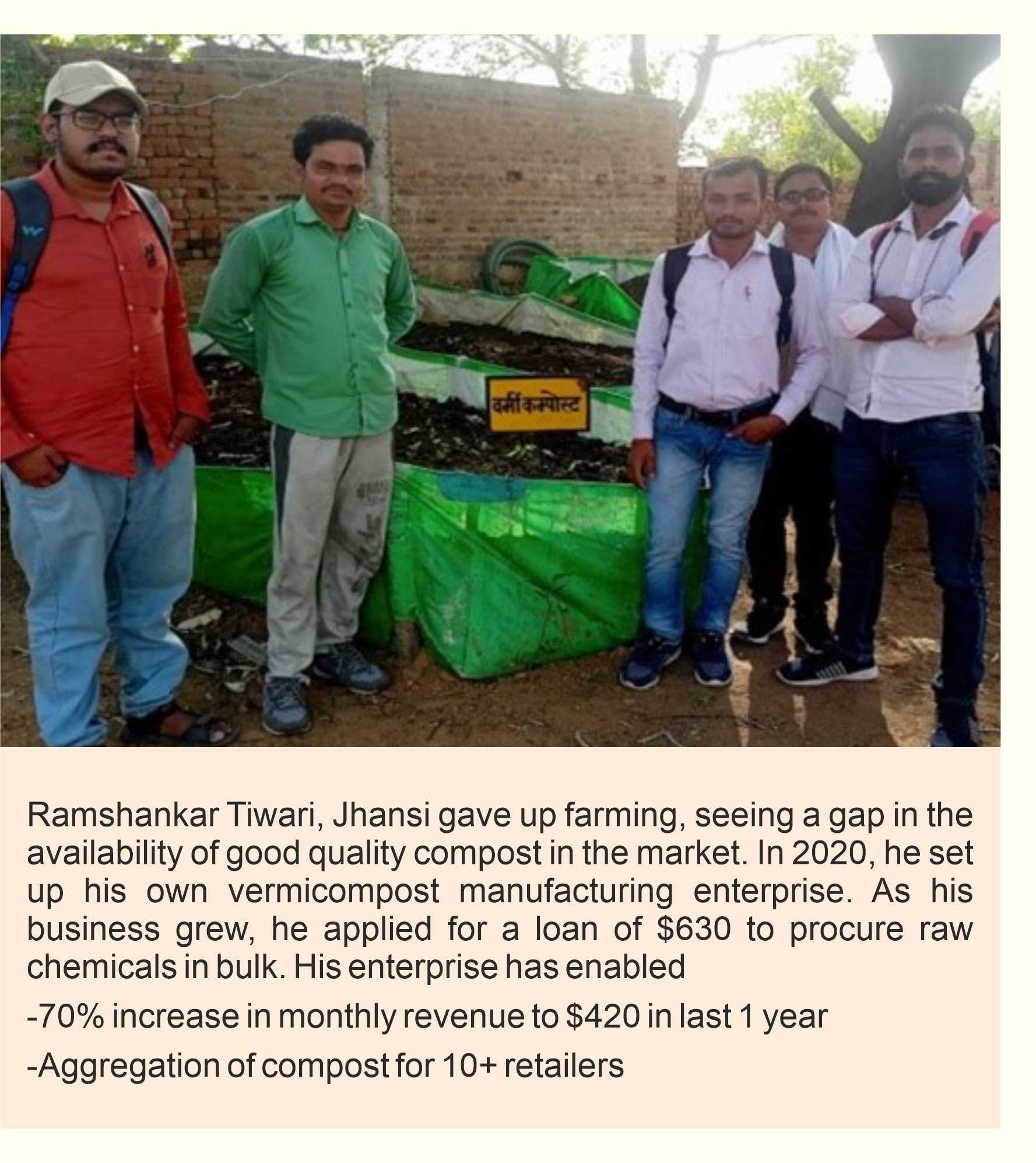

Capitalising on community assets

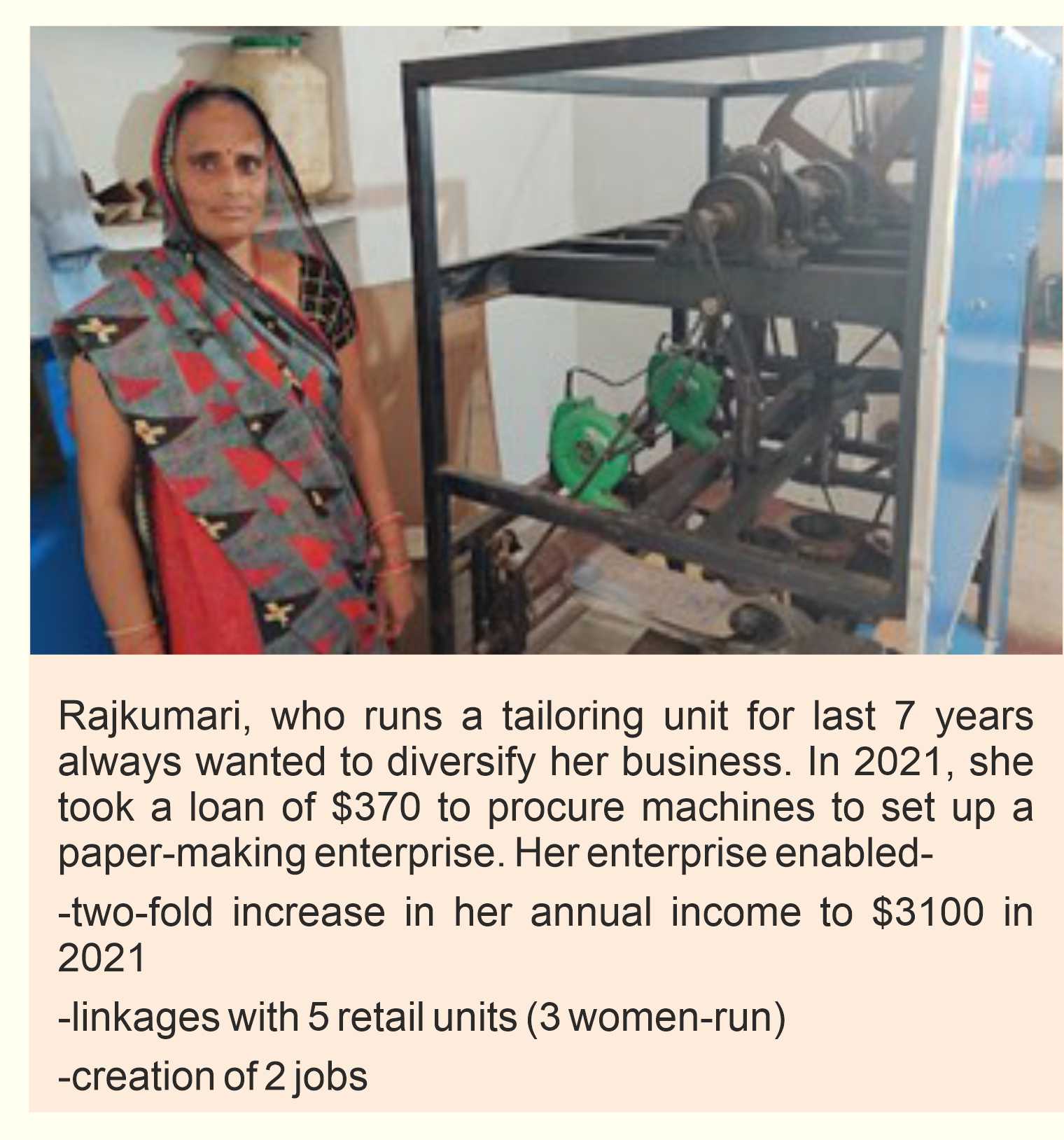

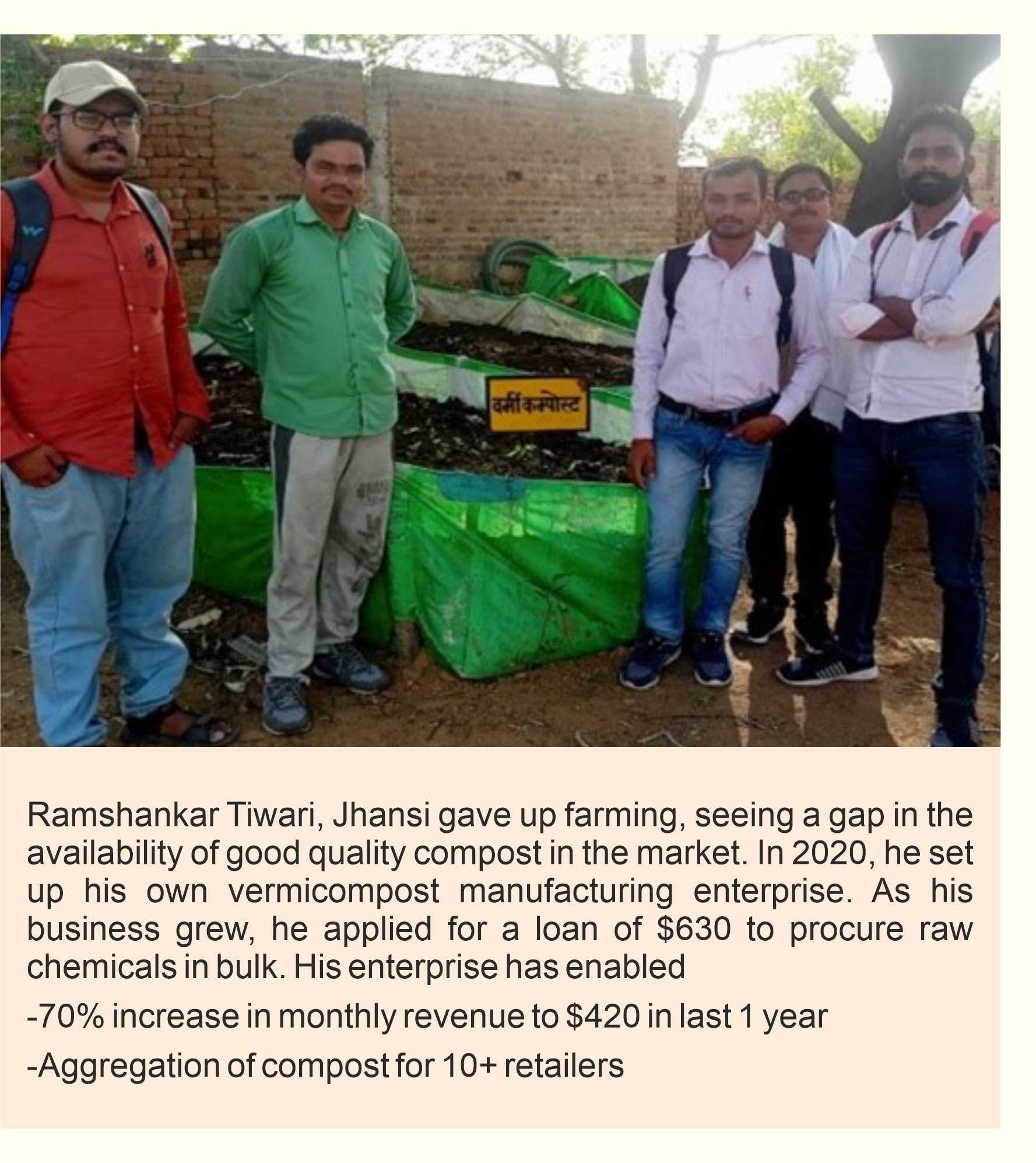

To tackle the challenge of access to finance for micro-enterprises in rural regions, DA leveraged the power of ‘community influence’ to develop a micro-credit facility (MCF). It is an inclusive credit-based facility, managed by three women-led self-help group (SHG) federations in the Jhansi and Niwari districts of the Bundelkhand region, providing micro-loans of up to $650. Such loans are provided to micro-enterprises that are technically feasible and financially viable. In the last four years, a total of 132 enterprises have been linked to the micro-credit facility, with a repayment rate of 99%, and loans worth $51,000 have been disbursed. The MCF has been supporting a diverse range of enterprises from vermicomposting manufacturing units to information centres and e-rickshaws. Efforts are currently underway to replicate this model in other locations.

Influencing financial institutions

DA has established a multi-stakeholder, collaboration platform, called as Regional Entrepreneurship Coalition (REC), in seven districts including Niwari, Madhya Pradesh and Jhansi, Mirzapur, Bhadohi, Basti, Bahraich, and Lakhimpur, Uttar Pradesh to collectivise efforts of entrepreneurs and stakeholders working towards entrepreneurship development. By encouraging synergies and resource optimisation among various departments, RECs have supported over 250 micro-entrepreneurs since 2018. Along with building partnerships with training institutes, government departments, and academic institutions, this platform has also enabled the co-creation of innovative and context-relevant solutions with banks, Non-Banking Financial Companies (NBFCs) and MFIs to provide credit products and services to diverse range of entrepreneurs. For instance, the REC in Mirzapur district has helped more than 250 entrepreneurs to access loans from financial institutions and support under government schemes worth $175,000 in the last five years from multiple stakeholders such as financial institutions and government departments at the district level.

Alternative lending platforms

The term ‘alternative lending’ refers to a broad range of loan options that are accessible to business owners in addition to traditional bank loans. Platforms that allow for alternative lending enable individuals to get access to affordable loans when she/he is unable to get a typical bank loan for any reason. One such platform is Rang De [rangde.in], a peer-to-peer social investing and lending platform, in partnership with the Indian Micro Enterprises Development Foundation (IMEDF). Rang De connects social investors with the community of entrepreneurs. At Rang De, each borrower can access innovative credit products that cater to the particular needs of the borrowers. During the last seven months, over 600 loans worth approximately $314,000 have been disbursed through the Rang De platform with a fixed interest rate of 8%.

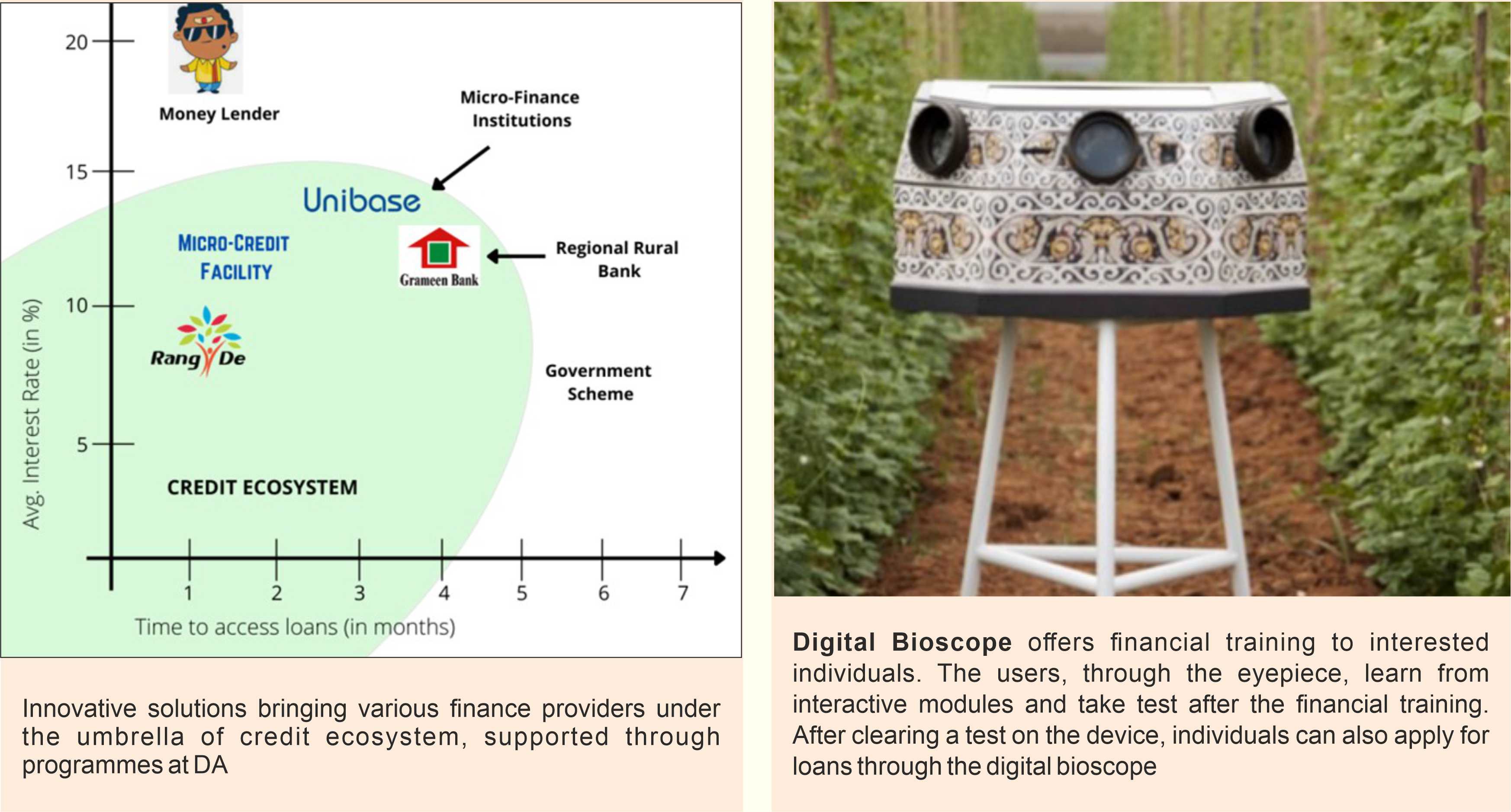

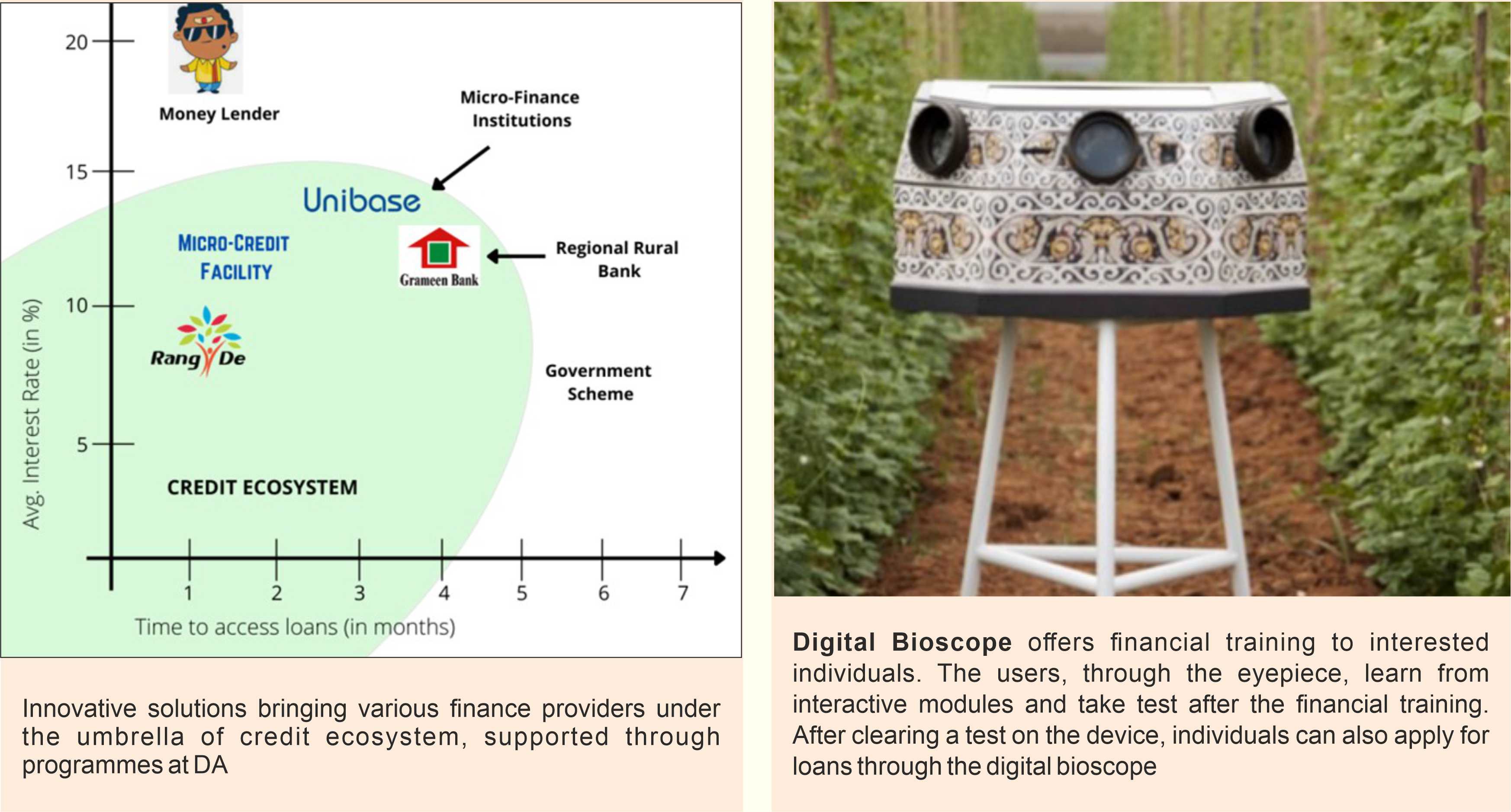

The portfolio of solutions has enabled DA and our partners to create an enabling local credit ecosystem for entrepreneurs to access timely loans at affordable rates. These innovations, built largely through local initiatives and collaborations, have been successful in creating impact at micro and meso levels in the form of either decreasing time to access loans or interest rates or both.

Future of innovative finance

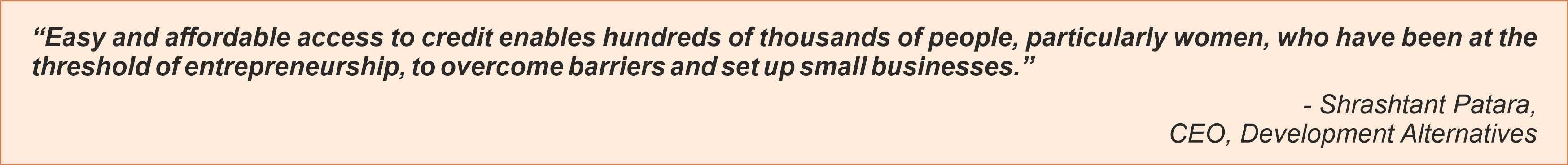

DA’s focus is now on innovating and developing cutting-edge prototypes and tools for inclusivity. One such prototype is the ‘Digi-Socio currency’, which assesses the creditworthiness of borrowers not based on financial grounds but by leveraging social matrix and connections. Such prototypes will also help entrepreneurs, excluded from the formal credit ecosystem, in accessing formal loans. In addition, acknowledging the fact that financial literacy is the first step towards financial inclusion, DA in partnership with Rang De, through its interactive financial literacy training, will ensure that financial literacy now reaches a wider swatch of people with the use of a ‘Digital Bioscope’.

For a large section of grassroots entrepreneurs who are out of the credit ambit or ‘digitally absent’, upcoming new credit protocol systems like Open Credit Enablement Network (OCEN) (Mulye 2021) are empowering new players (digital platforms) by:

- Reducing the entry barrier to offer financial services

- Enabling them to widen their market and provide innovative credit products

while reducing the cost of acquiring customers

- Utilising digital infrastructure in order to facilitate presence-less, paperless

and cashless service delivery (Sahamati 2020)

To address the challenge of access to finance at the right place and right time, DA has partnered with financial institutions at micro and meso levels. These partnerships will strengthen the existing financial delivery systems along with innovating new products and services, enabling rural communities to move a step closer to entrepreneurship.

References

Bandyopadhyaya, T. (ed.) 2021. Inclusive Finance India Report 2020. New Delhi: Access Assist. Details available at https://www.accessdev.org/wp-content/uploads/2021/07/Inclusive_Finance_India_Report_2020-1.pdf, last accessed on 24 August, 2022

GoI (Government of India). 2022. Annual Report 2021-22. New Delhi: The Ministry of Micro, Small and Medium Industries, Government of India. Details available at https://msme.gov.in/sites/default/files/MSMEENGLISHANNUALREPORT2021-22.pdf, last accessed on 24 August, 2022

Mulye, D. 2021. What is OCEN and what it means for Digital Lending. FinBox. Details available at https://finbox.in/blog/what-is-ocen-embedded-credit-digital-lending/, last accessed on 24 August, 2022

Sahamati. 2020. OCEN & Account Aggregators will change digital lending in India. DigiSahamati Foundation. Details available at https://sahamati.org.in/blog/ocen-account-aggregators-will-change-digital-lending-in-india/, last accessed on 24 August, 2022

Ankit Mudgal

amudgal@devalt.org

Muskan Chawla

mchawla@devalt.org

Back to Contents

|

To overcome this challenge, Development Alternatives (DA), through various projects, has innovated solutions that are community-led and provide easy access to collateral-free, formal credit at affordable rates. DA’s three-pronged approach for meeting the financial needs of communities includes options such as:

To overcome this challenge, Development Alternatives (DA), through various projects, has innovated solutions that are community-led and provide easy access to collateral-free, formal credit at affordable rates. DA’s three-pronged approach for meeting the financial needs of communities includes options such as: