|

Tracking Green and

Responsible How green is government's own spending? Indian Government spends 20 Ė 30 % of the GDP on public procurement.1 There is neither a formal public procurement policy nor a law in India. There is a pressing need for both, as rules without law lack enforceability and law without policy support suffers from a lack of coherent justification or rationale for the provisions made. Sustainable procurement is a process whereby organisations (public or private) procure goods and services in a manner that generates benefits to the organisation, society and economy, while ensuring that the environmental impact is minimal. Given the massive size of public spending, public sector in India can be a prime driver of sustainable production and consumption and can create environmental and economic benefits.

In India, public buying has been used as a

medium to achieve

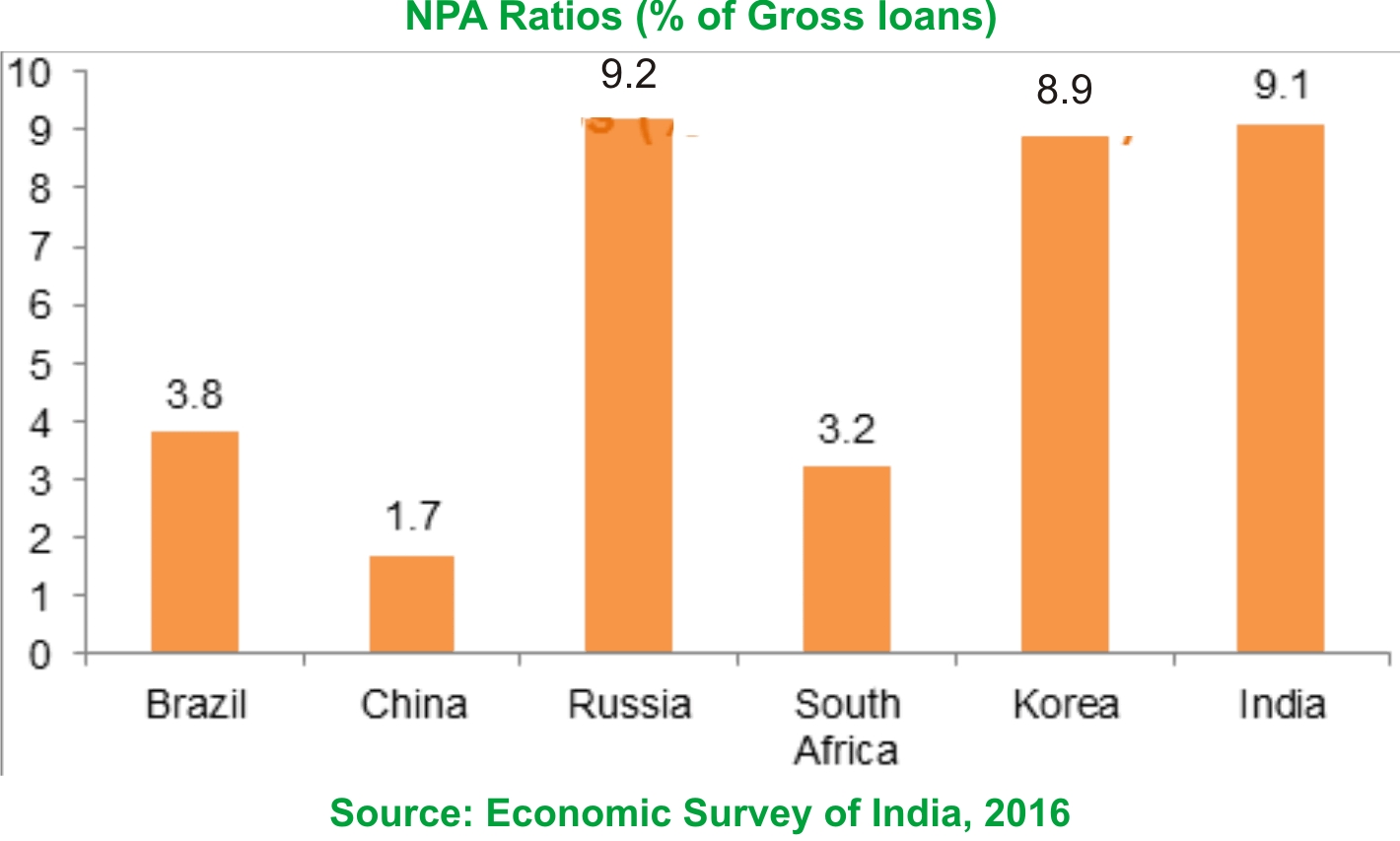

Since there is no law on public procurement, preference for certain kind of products and services in the procurement process therefore has been introduced through policy measures and guidelines. These are primarily department led and focus on promoting procurement from micro and small enterprises (MSMEs) or give preference to indigenous procurement in the defense sector. How green and responsible are investments by National Financial Institutions in India? Banking sector is generally considered as environmental friendly. Environmental impact of the banking sector such as use of energy, paper and water is relatively low and clean as it is not physically related to the banking activities but with customers' activities. The Reserve Bank of India (RBI) issued a circular in December 2007, emphasising the important role banks play in establishing institutional mechanisms to promote sustainability and so should act responsibly. Green Banking is like normal banking, which considers all the social and environmental / ecological factors with an aim to protect the environment and conserve natural resources. There are no green banks currently in India. Government-owned Indian Renewable Energy Development Agency, the country's only non-banking finance company dedicated to clean energy funding has begun work towards converting itself into a commercial bank. In India, YES Bank and IL&FS have joined UNEP's Finance Initiative and IDFC has adopted the Equator Principles.2 Financial Institutions and banks are not supposed to release funds unless environmental clearances have been obtained. However, there have been a number of projects funded by the Development Finance Institutions (DFIs) that have been extremely controversial from an environment point of view (Mandal and Venatramani 2012). Paralleled with growth in industry and infrastructure, the Non-Performing Assets (NPAs) of Indian banks, particularly that of the public-sector banks (PSB), have been witnessing a steady rise. At its current level, India's NPA ratio is higher than any other major emerging market (with the exception of Russia), higher even than the peak levels seen in Korea during the East Asian crisis.

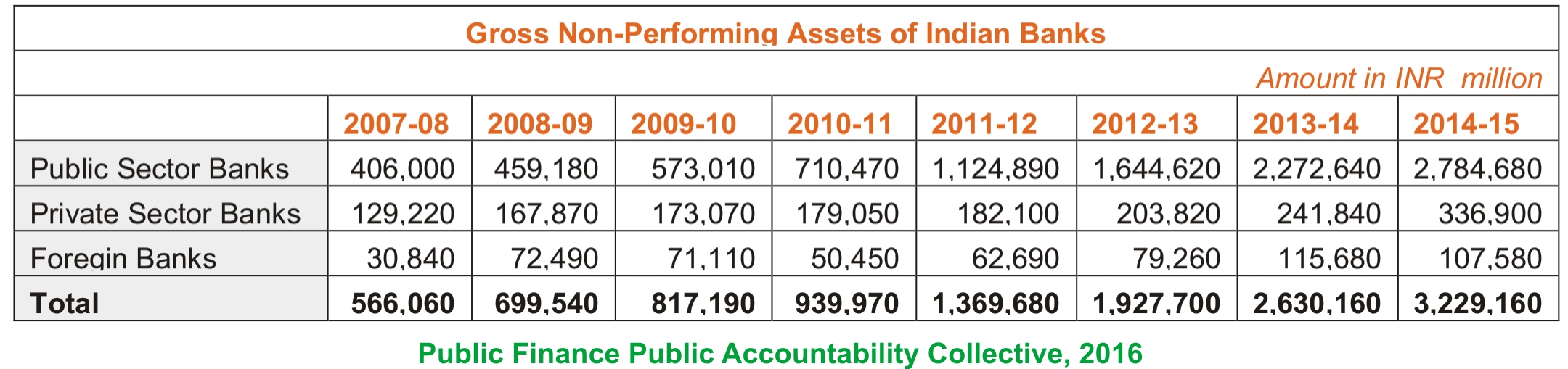

How big is the Non-Performing Assets problem? Bad loans (or non-performing assets) in Indian banks have risen from INR 566 billion in 2007-08 to INR 3 trillion in 2014-15. This is an increase of 470% in a span of 7 years . Public sector banks amount to much higher amount of bad loans where as private sector banks have managed to maintain low levels of NPAs as compared to the public sector banks. The Public Sector Banks' share of total NPAs increased from 65% in 2008-09 to 86% in 2014-15 while the Private Sector Banks for the same period brought down their share of NPAs from 24% to 10%.

Some insights

Conclusion

Moving financial flows to be more green and

responsible will require a push through both policy initiatives as well

as, private business and investment practices. While some progress has

been made towards greening investments by financial institutions, non

performing assets currently seem to eclipse the financial sector away

from being green and fair.

■ 1 (United Nations Office on Drugs and Crimes, 2013) 2 Equator Principles are voluntary guidelines for categorising, assessing and managing environmental risks when providing project finance in excess of USD10 million. The Equator Principles are reportedly based on the International Finance Corporationís (IFC) Performance Standards on Environmental and Social Sustainability, and on the World Bank Groupís Environmental, Health and Safety Guidelines. 3 The central bank defines these as debtors to whom lenders have an exposure of at least INR 50 million. 4 Lending to farmers, small scale entrepreneurs and other marginalized sections of society.

Anshul S Bhamra |

various

social objectives such as reducing unemployment, providing employ-ment

to disabled individuals and to backward regions in the country,

promoting gender and ethnic equality etc. The focus has largely been on

social aspects of sustainability.

various

social objectives such as reducing unemployment, providing employ-ment

to disabled individuals and to backward regions in the country,

promoting gender and ethnic equality etc. The focus has largely been on

social aspects of sustainability.