|

Making Dreams Come True Experience in Credit-based Housing in Bundelkhand C The story began with a need for finance for the middle income group families. Due to frequent drought conditions rural Bundelkhand, a highly fragile natural resource base with poor agricultural productivity and limited livelihood options, was facing problems such as the absence of regular incomes, leading to a struggle for the access to adequate shelter. The addition to an existing house or a new construction is managed out of squeezed-out savings, especially for the middle income group families. Development Alternatives and Habitat for Humanity (HFHI) India collaborated to facilitate a sustainable habitat development process in rural Bundelkhand. Financial and technical services have been the main support offered by the programme to a 100 targeted families to aid them in achieving permanent shelters.

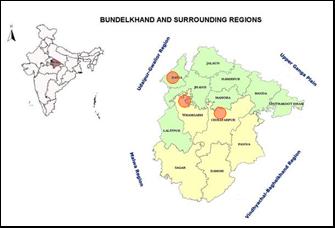

Project villages are located in three districts of Bundelkhand - Chhatarpur, Tikamgarh and Datia - in 12 villages within a range of about 100 kilometres around TARAgram, Orchha. Three partners have joined hands with DA Darshana Mahila Kalyan Samiti in Chhatarpur and Sarthak and Sandhan Jan Kalyan Sewa Sansthan in Tikamgarh. Capacity building exercises for partners, masons and the targeted families were highly emphasised in the overall strategy. Pre-project Foundation Activities Two training programmes were conducted in Chhatarpur and Tikamgarh districts in the partner areas for masons, building material producers and supervisors in appropriate technologies such as rat-trap bond, installation of RCC door-window frames and MCR tiles. Liaison with banks and the government was pursued to leverage finances for construction of the houses. An outcome of two masons’ training programmes supported by Zila Panchayat, Tikamgarh was the linkage of Indira Awas Yojana (lAY) beneficiaries with the DA-HFHI scheme. As part of the development, DA’s SHG members, earlier linked to livelihoods in Mador village, leveraged RS.25000 from government grants for the lAY beneficiaries and RS.12000 from DA HFHI scheme to access housing. To establish project management

systems locally, community processes were

The families were encouraged to opt for bulk purchase of construction material and assist in designing their own houses with respect to the organization of spaces, position of openings, and choice of material, etc. Toilets were made an integral part of the house. The site supervisors and community process coordinators visited the families and construction sites frequently to solve any emergent issues. The initial phase of the project underwent numerous hurdles. Most of the potential house owners were apprehensive about the technologies and followed a ‘wait and watch’ policy waiting for others to initiate the construction as per the new technology. The project saw frequent breaks owing to agriculturally active seasons, long-term celebrations of festivals in rural areas, outbreak of Chikanguniya epidemic and also drought, which caused water scarcity. Later, it translated into a laidback attitude on the part of the house owners when they would not adhere to the construction schedule. To counter the situation, the released loan amount was recovered and, in some cases, selected beneficiaries were cancelled if there was wilful non-cooperation. In the peak season of water scarcity, beneficiaries in some of the villages were supported with water tankers to aid in the construction.

Aparna & Sharad Pant |

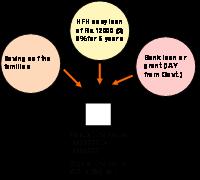

The financial model arrived at

was onethird of the cost of construction coming from the target family

in the form of savings, one-third grant or bank loan support and the

rest one-third as an easy loan from HFHI. As per the prevalent rates of

construction and materials during the project development, a house with

a room, kitchen, a verandah and a toilet-cum-bath in an area of 250 sq

ft. was estimated at RS.36000. Thus, the loan component from DA-HFHI was

RS.12000 to be repaid in five years at 4% interest rate, mainly to

adjust against inflation. Another 2% surcharge was added against service

costs.

The financial model arrived at

was onethird of the cost of construction coming from the target family

in the form of savings, one-third grant or bank loan support and the

rest one-third as an easy loan from HFHI. As per the prevalent rates of

construction and materials during the project development, a house with

a room, kitchen, a verandah and a toilet-cum-bath in an area of 250 sq

ft. was estimated at RS.36000. Thus, the loan component from DA-HFHI was

RS.12000 to be repaid in five years at 4% interest rate, mainly to

adjust against inflation. Another 2% surcharge was added against service

costs. strengthened with awareness

generation about sustainable building practices, making the scheme

comprehensible to the target group; several MoUs were signed between the

local partners and DA, beneficiary and the agency (local partner I

DA), with masons, etc. These documents carried details related to

the roles and responsibilities of various stakeholders involved,

expected results, finance delivery and repayment schedule, etc.

strengthened with awareness

generation about sustainable building practices, making the scheme

comprehensible to the target group; several MoUs were signed between the

local partners and DA, beneficiary and the agency (local partner I

DA), with masons, etc. These documents carried details related to

the roles and responsibilities of various stakeholders involved,

expected results, finance delivery and repayment schedule, etc. In some of the areas,

convincing families to build windows in the houses was in itself a

challenge, leave alone the acceptance of technologies. The project in

its totality is being appreciated for its technical and financial

services. Where initially the rat-trap technology was looked at with

suspicion in terms of its functionality and durability, now it is being

talked about for its speedy execution, cost-effectiveness, thermal

comfort and aesthetic appeal. The house owners themselves experienced

the cost comparison and benefits of rat-trap technology over the

traditional brick masonry in mud-mortar. They have become propagators of

the DA-HFHI scheme for cost-effective houses provided under close

supervision by professionals and the added facility of a soft loan. In

the six months’ period, when the first set of houses was completed, the

loan repayments are on schedule from most of the families. Local

collection systems have been established at the village level to support

the collections.

In some of the areas,

convincing families to build windows in the houses was in itself a

challenge, leave alone the acceptance of technologies. The project in

its totality is being appreciated for its technical and financial

services. Where initially the rat-trap technology was looked at with

suspicion in terms of its functionality and durability, now it is being

talked about for its speedy execution, cost-effectiveness, thermal

comfort and aesthetic appeal. The house owners themselves experienced

the cost comparison and benefits of rat-trap technology over the

traditional brick masonry in mud-mortar. They have become propagators of

the DA-HFHI scheme for cost-effective houses provided under close

supervision by professionals and the added facility of a soft loan. In

the six months’ period, when the first set of houses was completed, the

loan repayments are on schedule from most of the families. Local

collection systems have been established at the village level to support

the collections.