|

Innovative Financing for ICT Initiatives in the Third world The recent World Summit on the Information Society (WSIS) reconfirmed what has been widely acknowledged for some time, that a better and more widespread use of information and communication technologies (ICT) could bring large benefits to the citizens of developing countries. Radio, television and audiocassette devices have already made significant inroads into the lives and livelihoods of all but the remotest communities. The telephone is spreading gradually, and with the growing investment in new fiber optic and wireless technologies coming on the market, it will in time reach even many of the outlying areas of the Third World that are underserved today. The Components of an

Effective ICT Service However, a very large part

of the promise of ICT for contributing to the eradication of poverty

lies in increasing the use of data

processing and data communication technologies, particularly the

computer and the Internet. To reach their users, who are widely

distributed, these technologies have to be decentralized and made

available in a manner that is accessible to all and at costs

affordable by all. This requires several changes from current

practice, such as the intensified use of local languages, the local

generation of local content, the combining of online with offline

products and the extensive reliance on shared access facilities. For

the impact of ICT to reach its full potential, several preconditions

must be met, including particularly:

A Typical ICT

Network Functions of mother unit (National or Provincial level):

The relationships between the mother business entity and the local ones can be designed to suit the specific context. At one end, it can be the simple vendor-client transaction exemplified in the use of an ISP by an independent cyberkiosk. At the other extreme, the local entities can be wholly owned branches of the company. In between lie the rich possibilities of a franchising arrangement. Local Economy Revenues and Global Economy Costs The mismatch between the financial requirements needed to set up a system of this level of sophistication and the ability of the end-clients to pay for its services is probably the reason why few such facilities have been attempted so far. UNEP's Industry and Environment Volume 25 No. 2 April-June 2002 - Article "Making Development a Good Business" presents a detailed analysis of this problem and identifies the kinds of capital investments required to address them. A copy of the article can be viewed at http://www.devalt.org/newsletter/newopening.htm While most of these functions require non-trivial resources in the form of skilled professionals, infrastructure and institutional systems, the missing link in most developing countries is finance. Lack of financing systems remain the principal barrier to the rapid deployment of ICT in the non-metropolitan areas of the Third World. This paper addresses the particular set of issues relating to how a national ICT facility might be financed, both for the mother unit and for the local enterprises. It does not, however, address the building of infrastructure to provide the "pipelines" or "highways" that are generally seen to be necessary to deliver ICT for Development services and products for two reasons: 1. Powerful models already exist to provide a roadmap for these initiatives. The Universal Service Provision Fund and the ATT Mainland Ozark Model are two examples of how public funds were mobilized to cover the cost of supplying universal telecommunications in rual and remote locations in the US. The Tennessee Valley Authority (TVA) is a third example of how highly subsidized financing (with interest rates of 1% to 2% and long periods of moratoria) were made available to encourage the setting up of both the electrical and telecom backbones in the American hinterland. 2. ICT affords immediate and rapid solutions for development. Their deployment is greatly hampered by the cost of building the required infrastructure, a lengthy, costly and complex task. The benefits of these technologies needs therefore to be provided without the installation of large-scale centralized infrastructure, the possibility of which has been demonstrated by a number of on-the-ground programmes. The focus of this paper is

therefore on the financing of initiatives that either use existing

infrastructure or set up decentralized means for power and / or

connectivity. The first premise, based on

limited but credible experience, is that it is possible to set up an

ICT facility that can, over time, become commercially viable even in

economies with relatively low incomes and little purchasing power.

Such a facility needs:

This means that

considerable capital investment is needed at the startup and early

stages until the venture has reached breakeven. Such initial capital

must be accessed at low cost and on relatively easy terms to enable

the business to build up its operations and capacity utilization

before it achieves positive cash flow. Although no actual enterprise

on the ground has achieved breakeven, plausible business plans show

that with sufficient numbers (of information products and users)

profits can gradually build up to a stage where further growth can

be financed through commercial investment capital.

=

Scalable and Sustainable Solutions

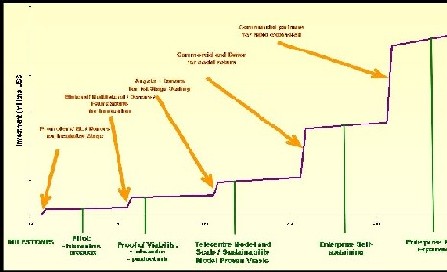

Corporate Social Responsibility (CSR) is often confused with philanthropy. The two concepts are actually quite distinct, with very little overlap in meaning. Philanthropy and "CSR" can only make a relatively limited contribution. If private investment is to be made on a truly scalable and sustainable level, it will need to see financial returns that are comparable to those from alternative uses of its funds. This means that ICT projects will have to rely on wholly new approaches, with business models and revenues that are attractive to commercial investors. One such approach is offered by the concept of Social Enterprise, a business entity whose purpose and products are designed to contribute to the public good profitability. The Lifecycle of an ICT Enterprise The Charts below describe

the sources of investment that exist today and the possible sources

that could accelerate the deployment of rural ICT facilities in the

future.

Chart - 2 schematically shows the typical lifecycle of a rural ICT enterprise and the various stages it successively goes through to reach a point where it becomes profitable and therefore attractive to commercial investors.

Design for a New Funding Mechanism for ICT4D The first part of this paper has addressed the critical issues of essential organisational, financial and operational structures for sustainable social entrepreneurs. It has also identified the current sources of funding available to such initiatives and proposed a basis of how funds for essentially social benefit versus private benefit should be sourced. The structures identified are essential components of any enterprise that has the commercial capacity to be self-financing after the viability phase, either through internally generated funds or through financial market mechanisms. We now address the Funding structure necessary to nurture and allow social entrepreneurs to achieve sustainability and scale. As noted during the panel

discussion at WSIS on "Innovative Financing Mechanisms for ICT4D: -

Venturing beyond the ‘Forever Pilot’ Syndrome", current

mechanisms for financing social entrepreneurs engaged in the ICT for

development field are inefficient and generally doom such efforts to

a perpetual start-up mode. Many of the issues were surfaced and

discussed during the panel discussion.

The Fund To resolve these impediments, a Mega Fund was proposed at WSIS, aggregating funds from Governments, Bilateral, Multilateral and other donors for ICT4D. We endorse this proposal but recommend a more broadly conceived mechanism. The Mega Fund – with a proposed working title of The Hope Digital Fund (HDF), should be composed of two sub-funds. The HDF for Social Advancement (HDFA) and the HDF for Sustainability (HDFS). This separation would allow the funding of social entrepreneurs through the most appropriate financing vehicles for the social and for the commercial components of a social enterprise. The HDFA would be funded by Bilateral, Multilateral, Foundations, and Corporate Responsibility Programmes (Donors). Its objectives would be to bear the start-up costs incurred by social entrepreneurs to build the infrastructure components and capacity building necessary to establish their business and normally paid for by society as a whole. The need for these funds has been previously discussed in this paper. These funds would be in the way of grants to the social entrepreneur. The HDFS would be funded by Donors and importantly by Corporations and the Financial Markets, and these funds would provide 2nd Stage and later funding in conjunction with the HDFA. HDFS will fund the social entrepreneur through a full range of market based financial instruments including equity stock, and various debt instruments. These funds would therefore generate a return for the HDFS and allow for flexibility in attracting incremental funds by generating returns for investors. Of course the investor will be given the option of re-investing the returns generated in either the HDFA or HDFS, allowing over time for a self-financing mechanism to promote ICT4D. The bifurcation of the Fund is essential for two reasons. First, the not for profit element is necessary to enable the enterprises to deliver social benefits while building up their capacity to become self-sustaining. The second is to attract a broad base of investors who require financial returns and are not currently players in these arena. A third paper in this series will address the issues of governance, financial instruments, and how they can be marketed to mobilise and manage a sufficient corpus for the funds to become significant and meaningful financing partners for social enterprise. Brief comments on overall fund structures to obviate flows in the current system are germaine. Fund Structure and Management It is proposed that the creation of the Fund and the fund raising be the responsibility of a central institution, either an existing recognised international organisation or one specifically responsible for the management of the fund. Full time staff be limited and the management group be virtual and connected digitally. In order to contain costs the secretariat of the fund must be located in the South. Fund raising and overall management of the fund would remain the responsibility of the HDF management group. Innovative financial instruments would have to deployed to attract a broad base of investors, especially for the HDFS. In order to ensure that the funds are distributed efficiently and cost effectively. Regional or Local institutions must be contracted to identify in-region social entrepreneurs qualifying for funding from the HDF. They would be responsible for performing due diligence, evaluating business plans and monitoring the performance of their Regional portfolio of investments. These regional entities would function as intermediaries with the HDF and "sell" their loans to the HDF. The compensation of such Regional or local mini-funds would be based on performance. The use of such regional organisations is a relatively recent development and has been successfully deployed by Donors to develop more cost effective and result oriented programmes to manage their development efforts. The proposed fund mechanism

would greatly facilitate the social entrepreneurs’ ability to

establish their enterprise by providing sufficient funding to attain

viability and eventually seek market based financing. In addition it

would eliminate sub-optimal and inefficient enterprises who focus on

fund raising at every step, rather than having an assured financial

base to achieve operating viability. The intent of this proposal is to combine the best practices of both Donors and Business to create the most efficient and sustainable mechanism to harness the awesome power of ICT for Development as quickly and sustainably as possible. The world can not tolerate another generation of women and children lost to broken and undelivered promises. ICT not only offers us an opportunity to redesign and deliver the widespread benefits of technology to the most remote location, it also offers us a new approach to Sustainable Development. An approach that will empower people to take control of, and manage their lives. To fulfil these lofty goals we must also redesign the institutions, which are charged with ensuring that for once, we, the international community, deliver on our promises. q

Ashok Khosla & Ranjit Khosla |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||