|

Challenges and

opportunities for

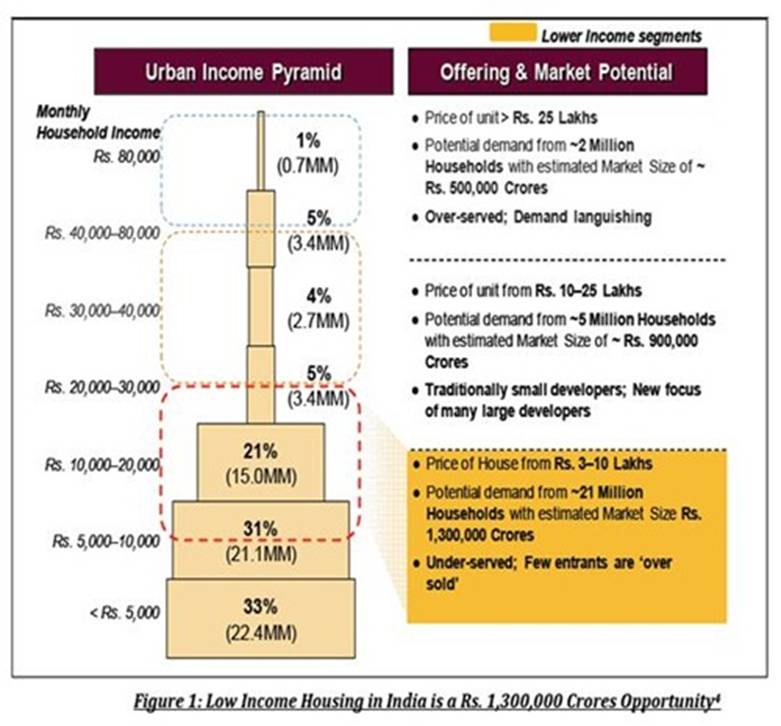

A bout 100 million people live in deplorable conditions in slums and slum-like conditions in India. They struggle for even basic facilities of living. With the number of urban dwellers expected to reach almost 5 billion by 2030 and the number of families earning more than Rs. 2 lakh per annum set to double to around 20 million in the next two years, demand for small and simple apartments is going to expand rapidly.Demand for Eco Housing Today middles class (upper-Base of Pyramid or upper-BoP) and low income housing families (Base of Pyramid or BoP) need affordable or value housing. Affordable housing can be defined as homes meant for population with income level of less than Rs. 1.5 to 3 lakhs per annum with demand of around 300 to 600 sq ft as dwelling area. As per the report by HDFC Chairman, Deepak Parekh, the equated monthly installment (EMI) that this segment can shell out is generally 30-40 per cent of the monthly income. According to the estimates by Monitor, a USA based consultancy, nearly 21 million low income urban households can afford houses priced between Rs. 3 and 10 lakhs, making this a Rs. 11 trillion market. At the same time, it must be noted that affordability does not mean compromise on quality of construction and socio-economic infrastructure.

Demand and Supply Affordable housing presents a business opportunity on the demand as well as the supply side. On the demand side, consumers will get access to cheaper alternatives to accomodation; developers will get to expand their presence and; financial institutions can experiment with innovative financial models to broaden their target audience. On the supply side, it can give impetus to a business model for setting up micro enterprises suppliers for building materials along with aggregators of such supplies that provide bulk supplies to developers. Over the last three years, the economic downward spiral has attracted attention on this market of the big real estate developers and large corporations. Developer Project Internal Rate of Return (DPIRR) can be as high as 40-50 per cent with gross margins in the range of 20-30 per cent. Entrants in the New Space Recently, over 25 affordable housing projects have sprung across India, with Mumbai and Ahmedabad being the hotspots. According to the Monitor, more cities have joined the trend in the last two years. Realty majors such as DLF, Tata Housing, Sobha Developers and Unitech are looking to launch projects in the bracket of Rs. 10-30 lakhs. However, at this stage players are still cautious considering that the tax applicable to affordable housing is the same as applicable to housing in general. This drives up the cost of construction (which is passed onto the buyer) along with diminished margins for the developer. Players such as Kerala-based Muthoot Pappachan Group and Janaadhar Constructions supported by Rockefeller Foundation have also entered the fray. Their focus is sub-10 lakh housing category and hence is more likely to suit the needs of the low income class. Researches show that the targeted audience earning Rs. 7,000-15,000 per month is lagging behind in the race for purchase of these apartments. Firstly, it is a struggle for them to put together resources for a big ticket purchase. secondly builders hike price tags on their projects every six months due to rising demand from cash rich buyers and cost overruns from unnecessary regulatory delays. Shortfall of MFIs While the market of low income housing is set to rise, there are concerns regarding the availability of micro finance market for housing loans. There is still a deficit of loans accessible to the low income customer in urban India. Many of these customers come from no income proof (NIP) category to which commercial banks don’t service home loans. Here the role of special housing finance companies like Micro Housing Finance Company (MHFC) and MAS Financial becomes important who cater to this market charging a premium in the interest rate. These mortgage companies finance workers who operate cash based businesses but don’t necessarily have salary paperwork. However, this still does not provide respite to this segment of society as their income is not going up fast. Since MHFC’s 10-12 per cent interest loan rate cannot exceed Rs. 5 lakhs, rising property prices mean low income buyers have to shell out more for owning property. Hence there is need for designing a financial package (micro-mortgages and micro-loans) for customers of affordable, eco-housing solutions through best practices being shared amongst large financial and microfinance institutions (MFIs) interested in serving the target area. An initiative in this area has already been undertaken by the Monitor Group which has developed an indicative model for a housing finance company focusing on the low income sector. Prospects for Micro-enterprises Like most parts of the developing world, India too has been plagued with the challenge and consequences of unemployment and under-employment for over half a century. For long the thrust has been on farm based activities catering to a majority of the work force. However it is becoming increasingly evident that the land available is not adequate to absorb and support the work and income requirements of a large number of people. Given this scenario, it is clear that the vast majority will require micro-entrepreneurship opportunities for income security. More than two-thirds of the employment, production and revenue contributions by the manufacturing and the service sectors is generated from small and medium enterprises. So far, numerous efforts have been made by the governments, civil society organisations and the private sector to promote micro-enterprises. However with the onslaught of globalisation and liberalisation many of these are getting marginalised due to competition, fair and unfair. One of the methods identified for these micro-enterprises to survive and compete in a globalised economy is through businesses that aggregate micro-enterprises or Micro-Enterprises Aggregator Business (MAte). In the housing sector, these MAte(s) could serve as an aggregator of building raw materials for micro enterprises and also as a bulk supplier to buyers or developers. MAte(s) can serve various functions including improving efficiencies through aggregated logistics and high quality common services as well as focus on core competence and distributed costs and sustainable use of resources. They can enable scaling-up through better linkages and access to larger and cheaper finances, technologies and management expertise and formal and informal marketing channels. In addition, they can help enhance bargaining power through brand creation of micro-enterprises and by sheer power of numbers. Initiatives So Far Government agencies like the Khadi and Village Industries Commission (KRIS) and state boards (KVIBs), ‘TRIBES’, and handloom and handicraft commissions have been undertaking several of the MAte(s) functions as a support provided by the State to specific sections of society. Similarly there have been some civil society efforts on a relatively much smaller scale. In both these cases most of the initiatives have not been designed nor implemented as viable entities. More recently, the private sector including ITC, Hindustan Lever, Bharti Enterprises and others have identified MAte(S) as an opportunity to expand their business operations. Unfortunately most of these do not cater to either the employment or consumption needs of the poor and marginalised communities. Viable MAte(s) are available only among the large business corporations in the country. In the case of large business corporations, this activity is part of the normal corporate planning and business development activities. A large country like India urgently requires at least 10-15 MAte Generating Engines (MAtegatEs) promoting Mate(s). The primary purpose of MAtegatEs will be to identify and assess micro-enterprise assets that can be aggregated, incubated and spawned off. Role of DA Development Alternatives (DA) has a mission of creating sustainable livelihoods or jobs and self-employment opportunities that provide a decent income and give meaning and dignity to life, produce goods and services for the local market, and do not destroy the environment or the resource base. The strategy of the organisation has been to innovate, incubate and multiply new concepts, methods, products and services which are socially and environmentally relevant in a professional and business like manner. Over the last 25 years, DA has enabled approximately 1500 sustainable livelihood enterprises. The activities of organisation have directly touched the lives of nearly a million people spread across the country. Through its business affiliates, the organisation has been testing out the concept of micro-enterprises aggregating businesses over the last 15 years. There is an opportunity for organisatiions such as ours to set up a MategatE that will focus on technologies, micro-enterprises and aggregated businesses aimed primarily at the poor and marginalised communities. These should draw upon opportunities from within the organisation and like minded partners. Payal Mittalpmittal@devalt.org |